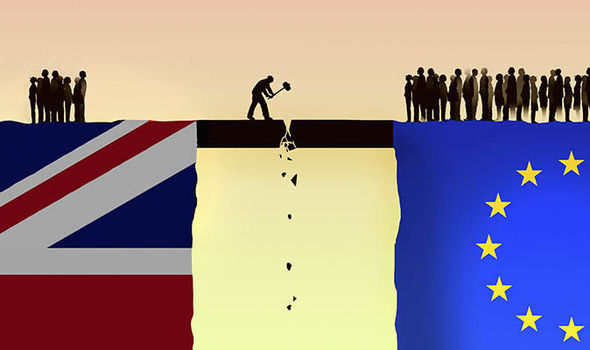

Feature: Readying the ship for ‘no deal’

Submitted by:

Andrew Warmington

Naheed Rehman, business lead consultant at Envigo, assesses the ongoing Brexit challenge

We are preparing for a number of possible Brexit outcomes, including a worst case ‘no deal’ scenario between the EU and UK, in which no transitional arrangement is in place after 29 March 2019, the UK exits the Single Market and customs union and hard borders are introduced.

Movement of animals

For both commercial and animal welfare reasons, the movement of animals between the UK and EU is already kept to a minimum. However, we anticipate that Brexit will include an increase in the administrative burden in completing necessary documentation for the movement of live animals at the port of entry. Contingency plans include consideration of whether to bring in additional animal stock to maintain availability through the March and April 2019 period.

Movement of goods to and from EU countries currently does not require such bureaucratic burdens as Convention on International Trade in Endangered Species (CITES) permits, export health certificates, commercial invoices or shipping statements. However, all movement of primate samples outside the EU currently requires a CITES permit and it is possible that, post-Brexit, these will be additional requirements for movements to and from the EU.

In preparation for a potential ‘no-deal’, Envigo is working with suppliers to stock adequate levels of key goods in order to limit any impact on customs clearance of supplies into the UK post-Brexit. There is the possibility of tariffs, adding costs to trade between the UK and EU (such as product standards or regulations), but WTO rules dictate that the EU will not be allowed to penalise the UK unfairly.

The UK would face the same non-trade tariffs as any other nation without a free trade agreement. Since a ‘no deal’ with a move to WTO protocols is possible, analysis is underway to understand the impact of tariff changes, should they occur post-Brexit. One forward-looking initiative open to companies is to review clearing agents to act on their behalf to deliver the most favourable tariffs possible.

GLP

The performance of GLP studies in the UK falls under the remit of the OECD council concerning the mutual acceptance of data (MAD). Any study performed by a member country should be accepted by any of the others. Since the UK is an adherent to the OECD MAD programme in its own right, Brexit has no impact on the acceptance of Good Laboratory Practice (GLP)-regulated non-clinical safety assessment studies performed there. Furthermore, since OECD regulations underpin these trials, no divergence between the EU27 and UK enforcement of GLP is anticipated.

From 29 March 2019, in a ‘no deal’ scenario, chemical substance companies are likely to be subject to the laws applying in the UK. The provisions of the Classification, Labelling and Packaging (CLP) Regulation may remain valid within the UK on the basis of the repeal bill, which will - at least temporarily - convert existing EU law directly into the UK legal system. UK-based companies exporting products to the EU27 will need to classify and label their products according to CLP regulatory provisions.

Without a deal, the UK chemicals industry will no longer be bound to the REACH Regulation and there will be no legal provision for the European Chemicals Agency (ECHA) to cooperate with UK authorities. ECHA has stated that UK authorities will lose access to the world’s largest database on chemical substance properties. These agencies will only have access to public information on its website. This will in turn impact the UK’s role as an evaluating member state and in ECHA’s Risk Assessment and Socio-Economic Analysis Committees.

What next?

The EU Withdrawal Act of June 2018 allows the UK to transfer EU chemicals regulation into domestic law. Consequently, the Health and Safety Executive (HSE) has been preparing statutory instruments and the legislative process. The HSE would perform the majority of roles for the UK, such as REACH and CLP. Moreover, the Department for the Environment, Food & Rural Affairs (DEFRA) says that it has nearly completed building the UK’s IT capability for the registration and regulation of chemical substances for market entry.

Existing registrations held by UK-based companies will be transferred directly to the replacement for REACH, legally ‘grandfathering’ the registrations into the British regime. Businesses with existing EU registrations being handled this way would be required to validate their existing registration with the HSE by opening an account on the new UK IT system and providing the required basic information within 60 days of the UK leaving the EU.

A transitional ‘light-touch’ notification process will be set up for UK companies importing chemicals from the European Economic Area (EEA) before 29 March that do not hold a REACH registration. This reduces the risk of supply chain disruption for companies that currently rely on a registration held by an EEA-based commercial entity.

In terms of plant protection, existing regulatory regimes will remain in place in the short term and companies will not stop trading. The same applies to biopesticides, with the UK and EU regulatory regimes – remaining unchanged in the short term, apart from administrative adjustments.

In the medium to longer term, the UK would not be legally committed to EU regulatory alignment in plant protection and would be free to diverge from developing EU legislation. All current active substance approvals, PPP authorisations and maximum residue levels will remain valid in the UK and EU, however.

Furthermore, the UK is not likely to be bound by the EU Biocidal Products Regulation and a stand-alone biocidal products regime may be established, with all decision-making repatriated to the HSE. All current active substance approvals and UK-approved biocidal products in place on 29 March 2019 would remain valid in the UK until their normal expiry date.

The HSE will, where possible, continue to process biocidal products post-exit day, granting national authorisations and potentially requesting re-submission of the information supporting original applications to enable substances to complete evaluations. The UK will not be legally committed to medium- or long-term regulatory alignment with the EU and divergence from EU legislation is likely.

Conclusion

Even in the case of ‘no deal’, industry influencers, the UK government and regulatory authorities are preparing and working to deliver as much continuity and the minimum of change possible for UK based chemicals and agrochemicals businesses.