Nippon Shokubai and Sanyo Chemical to merge

Submitted by:

Andrew Warmington

Japanese firms Nippon Shokubai and Sanyo Chemical Industries have entered into a basic agreement on a merger of equals, which should be completed in around December. Financial details were not disclosed and a final agreement has yet to be signed, but the current plan is to form a holding company and centralise their corporate functions, while operations will continue operating independently.

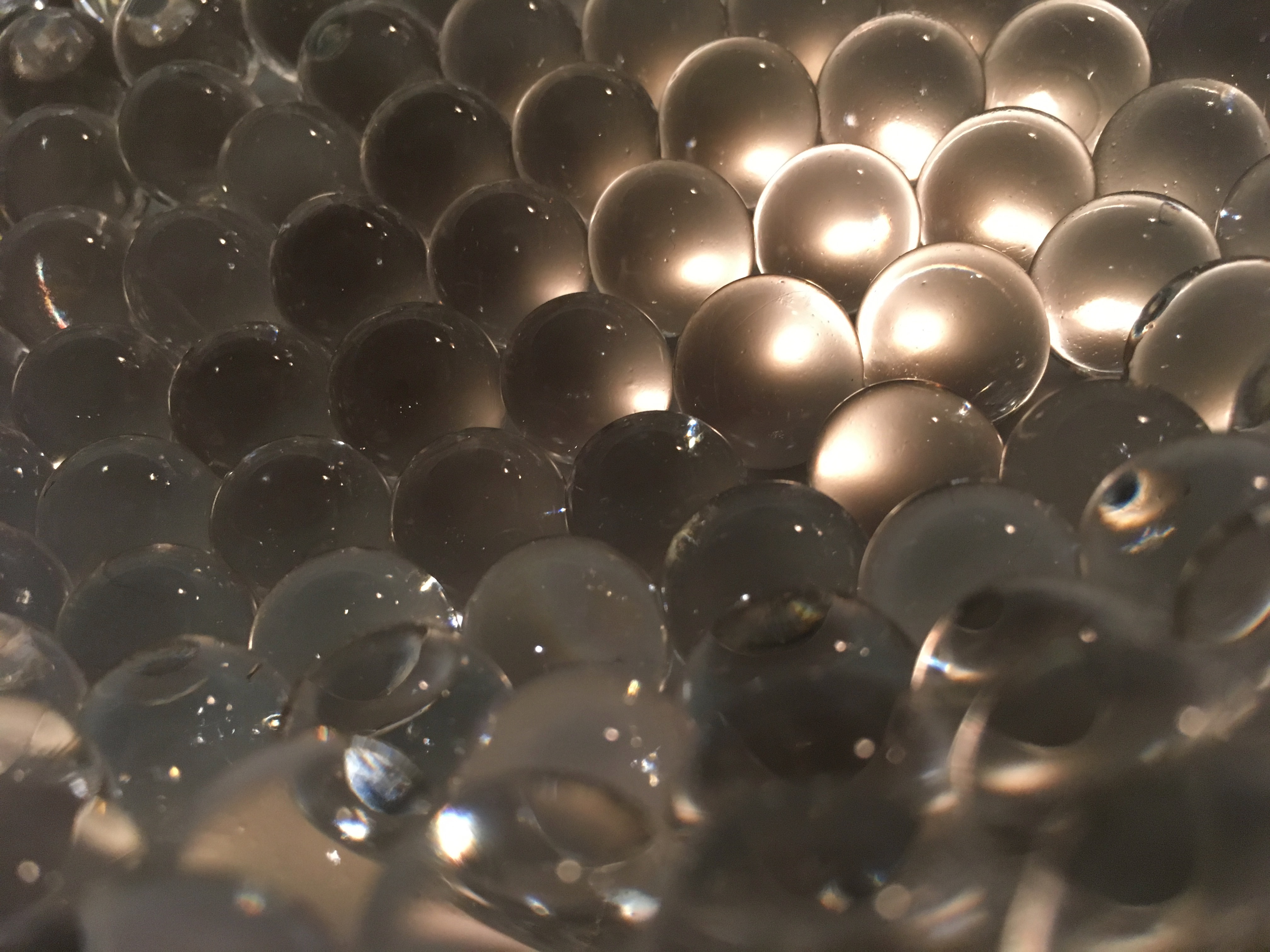

Nippon Shokubai is mainly active in basic chemicals, such as acrylic acid and ethylene oxide, plus high-performance functional chemicals and environmental and catalyst products based on them. Sanyo, meanwhile, is more focused on performance chemicals based on its surface activity control technology, supplying some 3,000 in all. They are both active in superabsorbent polymers (SAPs).

The two said that the agreement was driven by several factors, including the need for greater scale to address emerging markets and compete with larger European and American firms, especially in view of projected falling demand in Japan itself. In addition, the SAP market is seeing reduced profitability despite growing demand, with many regional players emerging.

Both had already set out medium-term plans to address these issues and saw that they had a “mutual complementary relationship”. Nippon Shokubai has a strong in-house value chain but is struggling to create new businesses to meet user needs; Sanyo, meanwhile, is good at manufacturing and marketing performance chemicals but very dependent on external raw materials suppliers, including Nippon Shokubai.

“With such recognition, the companies were exchanging opinions on various options including a business integration, and have reached an understanding that executing a business integration with each other is the best way to make use of the companies’ strengths, solve the business challenges and create a synergy effect,” they stated.

Expected business advantages include: a strong base through integrated technology and cost savings, particularly in SAPs, plus enhanced R&D capabilities; greater competitiveness and profitability through scale expansion; diversification of the portfolio; and faster development of new business. An enhanced ability to address the UN’s 17 Sustainable Development Goals as a merged entity was also cited.