Beyond fragmentation

Submitted by:

Andrew Warmington

Jennifer Cannon, president, commercial operations, pharma services, at Thermo Fisher Scientific explores the strategic and financial value of single-partner drug development models

Pharmaceutical and biotechnology companies face growing pressure to streamline development, shorten timelines and demonstrate value across every stage of clinical development. Yet many continue to rely on a fragmented outsourcing model, working with separate partners for clinical research, manufacturing and clinical supply services. This approach, while common, can introduce inefficiencies and delays, particularly when coordination across vendors breaks down. New research from the Tufts Center for the Study of Drug Development (CSDD) offers data-driven insight into an alternative clinical development model. The study, which is currently in peer review, assessed the financial and operational impact of aligning the chemistry, manufacturing and controls (CMC) activities with clinical trial study design and execution within a single supplier network.

The assessment used a well-established valuation model to explore when and where integration delivers the greatest value. The analysis was based on real-world clinical programmes supported through Accelerator* Drug Development*, a framework designed to unify process development, manufacturing, clinical supply capabilities and clinical studies within a single partnership structure.

Reexamining the status quo

Outsourcing has long been a core strategy for drug developers, enabling access to specialised capabilities and global infrastructure without the cost of building it in-house. But the traditional approach—contracting separately for manufacturing, clinical trials, lab services and distribution—requires significant coordination across different organisations that may not share systems, timelines or priorities.

In practice, this can lead to duplicated effort, miscommunication and delays. It also limits the ability to manage drug development efficiently as a connected whole. These issues are especially pronounced in therapeutic areas where development is complex and speed is critical, such as oncology and rare diseases.

A fragmented model also introduces risk. When different service providers operate in silos, sponsors may face challenges ranging from incomplete data handovers and

redundant documentation requirements to misaligned timelines and inconsistent quality oversight. These problems are exacerbated when clinical programmes involve multiple sites or countries, or when shipping conditions are complex, as is often the case with vaccines and cell-based therapies.

Consider, for example, an emerging biotech preparing for its first-in-human trial. Without coordinated support, it may struggle to align API characterisation, regulatory documentation, clinical protocol development and supply chain planning, leading to costly delays. Similarly, a global biopharma company managing hundreds of clinical sites may find that fragmented and redundant governance slows start-up activities and introduces variability across regions.

In both cases, even minor missteps can escalate into significant timeline disruptions. An integrated model, by contrast, consolidates multiple functions within a single partner network, creating shared oversight and accountability. While this strategy is not universally adopted, the Tufts study set out to evaluate its potential benefits using quantitative analysis.

Methodology & findings

The Tufts team used a risk-adjusted financial model called expected net present value (eNPV), which estimates the lifetime costs, risks, and returns of development programmes. The model included industry-standard assumptions for costs, success rates, and timelines, as well as operational data drawn from real-world trials.

To test the model, researchers focused on oncology, a therapeutic area known for its high costs and compressed timelines. They assessed a range of integration scenarios across Phases I through III and conducted sensitivity analyses to test how results held up under changing assumptions. The operational data supporting the model was compiled from integrated programmes executed through Accelerator Drug Development.

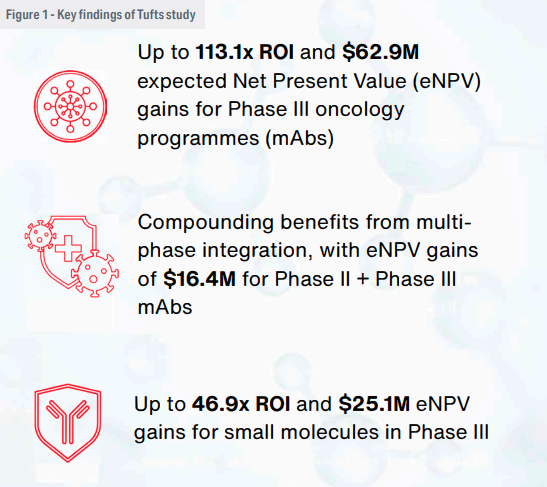

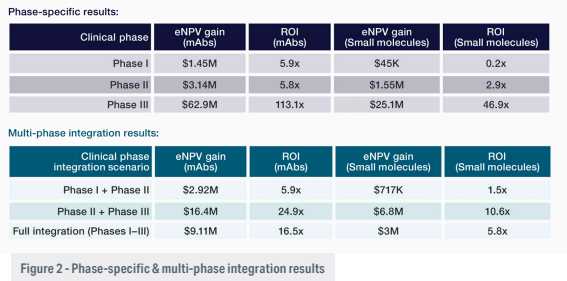

The results showed clear financial and operational gains from single-partner integration, particularly in later clinical phases. In Phase III monoclonal antibody (mAb) programmes, integration was associated with an average eNPV gain of $62.9 million and a return on investment (ROI) of 113.1. For small molecules in the same phase, the model estimated $25.1 million in eNPV gain and a 46.9 ROI (Figure 1).

Benefits were evident in earlier phases as well, though more modest. For example, integrating services in a Phase II monoclonal antibody (mAb) programme yielded a 5.8 ROI and an eNPV gain of $3.14 million. Gains increased when integration extended across multiple phases (Figure 2).

These timeline and cost improvements stemmed from reduced handoffs, fewer delays, more efficient use of resources and tighter alignment across development functions. The analysis also highlighted the impact of time savings. In oncology trials, even a one-month delay in Phase III can translate to $8 million in lost revenue due to deferred market entry and shortened exclusivity periods.

The findings also reinforce the compounding value of continuity. When integration is sustained across multiple phases, the combined operational efficiencies and reduced transition costs can yield even greater financial returns than single-phase improvements alone. Programmes that maintained integration from Phase II into Phase III, for example, saw eNPV gains climb significantly compared to those that adopted the model for a single phase.

Focusing integration in later phases

Although integrated strategies can be applied at any point in development, the data suggests that Phase III offers the greatest opportunity to realise measurable value. At this stage, assets are typically de-risked, having passed key clinical and regulatory hurdles. Programmes are larger and more complex, with higher resource investment and higher stakes.

Streamlining execution during Phase III can prevent costly setbacks and accelerate readiness for commercialisation and earlier market entry. The Tufts team also found that the ROI of late-phase integration held steady across a range of assumptions, reinforcing the robustness of these benefits.

This stage of development also involves a broader range of stakeholders, from regulatory bodies and supply chain teams to commercial strategists. A unified model allows for more consistent communication and decision-making, which in turn helps sponsors respond faster to late-stage data and regulatory feedback.

Laying the foundation earlier

While later-stage programs show the largest returns, the decisions made in Phase I can set the tone for future performance. Selecting a scalable partner, harmonising data systems, and aligning supply and regulatory planning early on can reduce downstream issues and bottlenecks and create continuity as programmes advance.

Early integration can also help sponsors avoid delays related to technology transfer, contract renegotiations and documentation gaps. These issues may not appear critical at the outset but can become major roadblocks as development progresses and operational needs increase.

Additionally, unified early-phase planning can enable more responsive scenario modeling, allowing sponsors to plan for multiple development paths based on emerging trial results. This kind of flexibility is increasingly valuable in oncology and other therapeutic areas where biomarker data and adaptive trial designs are changing how programmes evolve.

Strategic implications for developers

For biotechs and large pharma alike, the study provides a framework for evaluating when integrated outsourcing might make strategic and financial sense. Emerging companies may benefit from the operational support and cohesive oversight that a single-partner model provides, especially when internal resources are limited. Larger organisations managing diverse pipelines may find integration across CMC supply and clinical studies useful in improving efficiency, visibility and flexibility to make just-in-time decisions.

Sponsors may also consider integration as a risk mitigation strategy. In today’s environment, marked by geopolitical uncertainty, evolving regulatory expectations, and complex trial logistics, fewer handoffs and more centralised accountability can help prevent gaps in execution that jeopardise timelines or quality.

By grounding its findings in the operational structure of Accelerator Drug Development, the Tufts analysis adds real-world context to the modeling, demonstrating how integrated execution can be implemented and measured in practice.

Looking ahead

There is no one-size-fits-all approach to outsourcing in drug development. Every program has its own requirements, and some projects may still benefit from engaging with multiple specialised vendors. But the findings from Tufts suggest that integration, when applied strategically, can yield tangible gains.

In a landscape defined by high costs, compressed timelines and growing demand for innovation, the ability to manage clinical development holistically is no longer just an operational advantage. It is becoming a financial imperative and opportunity to accelerate commercialisation by reducing time to market.

* - Accelerator Drug Development is a trademark of Thermo Fisher